No Data

BIL SPDR Bloomberg Barclays 1-3 Month T-Bill ETF

- 91.710

- +0.010+0.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Vanguard Revises U.S. Market Outlook Amid Tariff Uncertainty

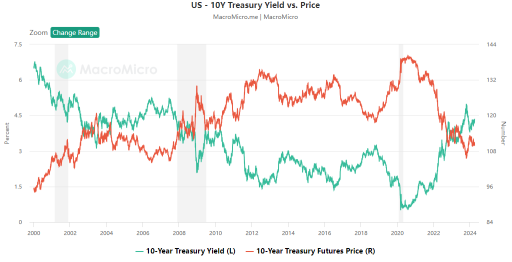

Société Générale: Treasury Yields Face Key Technical Tests as Downtrend Pressure Persists

Besent's new bond issuance strategy: short-term bonds "steady", long-term bonds "gradual", closely monitoring stablecoin "major investors".

On Wednesday, the USA Treasury will announce the bond auction scale for the quarter from May to July. The market expects the Treasury to continue issuing bonds at the established pace, with next week's quarterly redemption auction expected to remain around 125 billion dollars. Some believe the market may interpret this as the Treasury being more inclined to rely on short-term bonds, which is a positive signal for long-term bonds.

Barclays Affirms Long 5-Year U.S. Treasury Recommendation -- Market Talk

Opening: US stocks opened slightly higher on Monday. This week the market focuses on Earnings Reports and economic data.

On the evening of April 28, Peking time, U.S. stocks opened slightly higher on Monday. Over 180 S&P component stocks, including Microsoft, Apple, Amazon, and Meta, will release their Earnings Reports this week. Important data such as non-farm employment and GDP will also be released this week. Investors continue to pay attention to the progress of trade negotiations. China has once again clarified that there are no negotiations or discussions on tariff issues between China and the U.S.

U.S. stock index futures slightly lower as the busiest week of Earnings Reports season approaches | Highlights for tonight.

①IBM plans to invest 150 billion USD in the USA over the next five years; ②MicroStrategy increased its shareholding by 15,355 Bitcoins last week; ③Rating agencies have downgraded the outlook for US ports to negative; ④Reports: Tencent, Alibaba, and ByteDance are scrambling to purchase computing power resources.

Comments

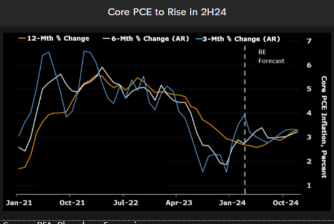

The release of the U.S. Consumer Price Index (CPI) data for August has once again confirmed market expectations regarding inflation trends.The year-over-year growth rate of the overall CPI has fallen to 2.5%, while core CPI remains stable. This not only indicates that market supply and demand are gradually balancing, but also provides investors with a good opportunity to rea...

In a text book manner, it was options expiry day April 19 so the market' pull back from its record all time highs was naturally going to be exacerbated. Shorts were exercised, the ASX200 $S&P/ASX 200 (.XJO.AU)$ dropped 0.98% on Friday, and then rose up 1.1% on Monday April 22, with market participants e...

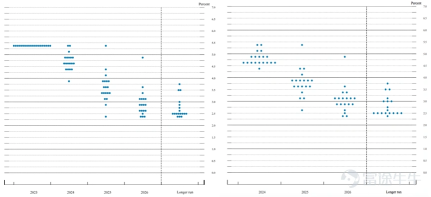

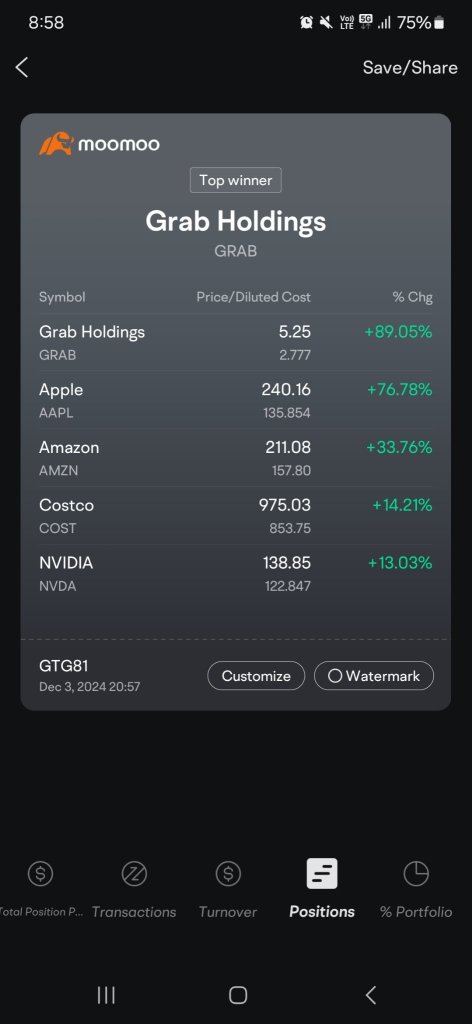

When central banks embark on an easing cyc...

最帅韭菜 : 2026 hit 1200 I think

Dontchaknowme 最帅韭菜 :