No Data

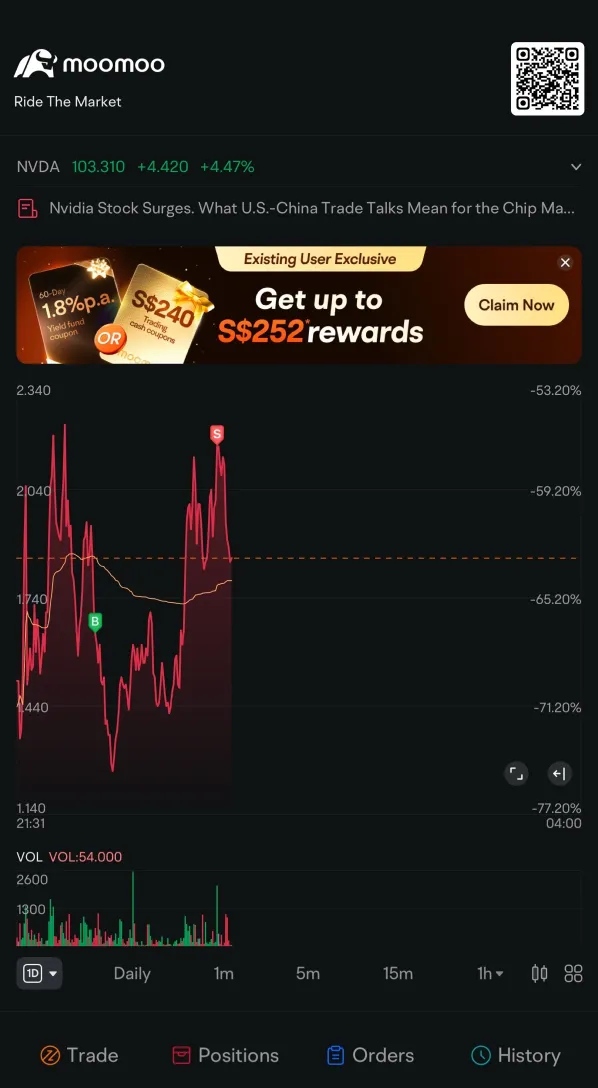

BAC250502C40500

- 0.32

- -0.01-3.03%

- 5D

- Daily

News

Bank of America Securities: Lowered the Target Price of TECHTRONIC IND to HKD 103, maintaining the Buy rating.

Bank of America Securities released a Research Report stating that TECHTRONIC IND (00669) is on track in revenue and profitability for the first half of the year, but visibility is low for the second half due to tariff impacts. It is expected to return to the right track next year, as the USA will no longer import manufactured products from China. The Target Price for TECHTRONIC IND has been lowered from HKD 125 to HKD 103. Considering the uncertainty of tariffs, the bank believes that a lower valuation multiple should be used for the Target Price. Given the company's strong balance sheet, growth of Milwaukee, and leadership position, the stock maintains a 'Buy' rating. The bank indicated that, on the Consumer side, housing transaction volume still faces challenges. Due to the stability of the high-income demographic and the middle...

Bank of America Securities: China Shenhua Energy's first-quarter net income disappoints expectations, lowering the target price to 32 Hong Kong dollars.

Bank of America Securities released a Research Report stating that China Shenhua Energy (01088) saw its net income fall by 19% to 13.4 billion yuan in the first quarter, missing expectations. The primary reason the quarterly earnings did not meet expectations was due to a more-than-expected drop in the average selling price of Coal. The bank has lowered Shenhua's net income forecast for this year to 2027 by 7% to 12%, reducing the Target Price from 33 Hong Kong dollars to 32 Hong Kong dollars, while maintaining a "Neutral" rating, citing the pressure on earnings from declining Coal prices. However, the company is in a net cash position, and management is committed to returning value to Shareholders. China Shenhua's quarterly revenue fell by 21% year-on-year to 69.6 billion yuan; gross profit decreased by 22% year-on-year to 21 billion yuan.

Bank of America Securities: Raised SD GOLD's Target Price to 26 Hong Kong dollars, reaffirming the "Buy" rating.

Bank of America Securities released a Research Report stating that SD GOLD (01787) achieved a net income of 1 billion RMB in the first quarter of this year, a year-on-year increase of 47%, and a quarter-on-quarter increase of 16%, in line with profit forecasts. Revenue reached 25.9 billion RMB, a year-on-year increase of 37%, and a quarter-on-quarter increase of 67%, primarily driven by rising gold prices. Combining the results for the first quarter of 2025 and the latest forecasts from this bank, it raised its earnings forecast for the fiscal years 2025 to 2027 by 2% to 7%. The Target Price for Listed in Hong Kong was raised from 22 HKD to 26 HKD; this bank reiterated its 'Buy' rating for SD GOLD, based on an optimistic view of gold prices, as well as 202.

BofA Awards Critical Funding for Conservation of Historic Artworks

Warren Buffett's 60-Year Legacy: What to Watch for at Berkshire Hathaway Shareholders Meeting?

Bank of America Asset Management: The valuation of the Bonds market has returned to a normal level, with various categories offering substantial premiums compared to U.S. Treasuries.

Bill Mertz, the head of Capital Markets research at Bank of America Asset Management, pointed out in a report that the current valuation of the bonds market has returned to a more normal range, with several categories of bonds providing significant excess returns over U.S. Treasuries. He noted that, on a tax-equivalent basis, municipal bond yields are 2.8% to 5.6% higher than Treasury bonds, while corporate bond yields, depending on credit ratings, have a premium of 1.0% to 3.8% over Treasury bonds. Mertz stated, "Higher-risk corporate bonds and municipal bonds may experience price volatility, but can generate considerable return in the long run." Additionally, non-institutional mortgage loans and guaranteed loan certificates (

Comments

It’s been an eventful week in the markets, with a dramatic shift in sentiment from Monday’s bearish close to a four-day rally starting Tuesday. This change resulted from improving tariff dynamics and slightly better-than-expected earnings reports. As a result, $NASDAQ 100 Index (.NDX.US)$ surged 6.43% for the week, $S&P 500 Index (.SPX.US)$ rose 4.59%, and $Russell 2000 Index (.RUT.US)$ gained 4.09%, reflecting str...

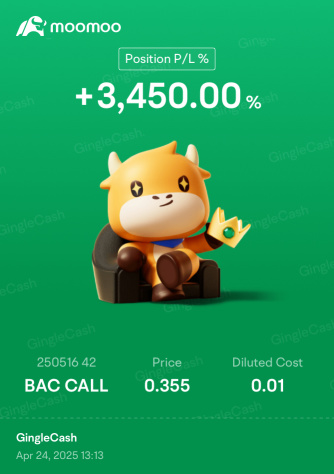

$Bank of America (BAC.US)$

Is Bank of America Corp. (NYSE:BAC) the Best Stock Under $100 to Buy According to Hedge Funds?