No Data

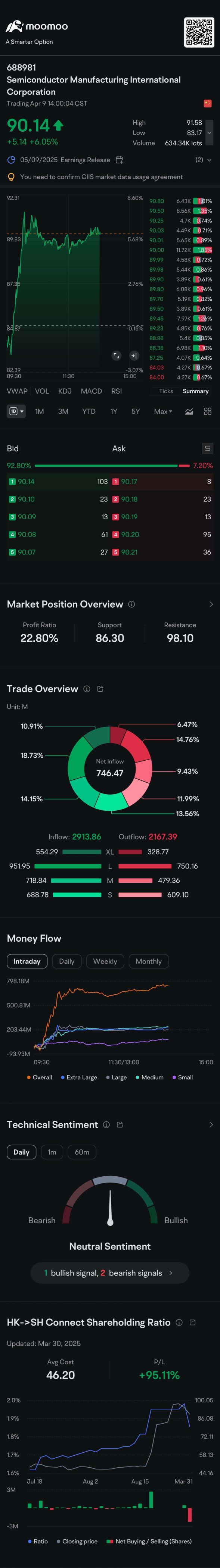

688981 Semiconductor Manufacturing International Corporation

- 88.98

- +0.98+1.11%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Chinese humanoid robots are seizing a global $5 trillion "big track"!

Morgan Stanley expects that by 2050, a total of 1 billion humanoid robots will be deployed globally, with annual revenue reaching 4.7 trillion dollars, nearly double the total revenue of the top 20 global Auto Manufacturers in 2024. China's policy support, technological advancements, and manufacturing foundation place it in a leading position in the field of humanoid robots, especially in the Hardware supply chain.

Domestic Semiconductors equipment manufacturers discuss how to break through in the Industry: The prosperity of end terminals like AI is being transmitted to the equipment sector, and tariff policies do not change the opportunities for growth overseas.

① Many semiconductor equipment manufacturers have stated that their product demand in this year's market is driven by growth in AI, 5G, Internet of Things, New energy Fund vehicles, and other emerging applications, leading to a continued rebound in the overall industry situation; ② Despite the intense changes in international trade policies, domestic semiconductor equipment manufacturers remain bullish on growth opportunities in overseas markets, and strengthen cooperation with domestic and foreign peers, customers, suppliers, etc. to jointly mitigate risks.

The market may reach a critical juncture in the short term, with Banks and Electrical Utilities showing repeated activity, and the Technology Sector poised to take off.

Track the entire lifecycle of the main Sector.

Why Nvidia Investors Shouldn't Worry About Huawei's New AI Chip

Frequent bullish policies emerge, a wave of investment in hard technology sweeps across. Experts suggest that the localization of Semiconductors and AI is expected to accelerate.

1. The "China Investment Development Report" mentions that by 2025, hard technology fields represented by Semiconductors and new production power industries will become important investment directions for various Institutions, with the investment amount expected to account for over 80%. 2. Zhang Zhiqian, director of the China Construction Investment Research Institute, believes that the A-share market will stabilize and rebound in 2025, with an increase of over 10%, potentially reaching 4,000 points.

Southbound capital tracking | The record of continuous net Inflow for 34 weeks has been interrupted, with significant Shareholding reductions in Xiaomi and Semiconductor Manufacturing International Corporation.

① This week, southbound funds had a net Sell of nearly 0.4 billion Hong Kong dollars. Which stocks experienced an Inflow of funds? ② Alibaba has seen a cumulative Inflow of over 4.4 billion Hong Kong dollars in the past 7 days. How did the stock price perform this week?

Comments

Yesterday, Hong Kong's stock market experienced a historic sell-off. The $Hang Seng TECH Index (800700.HK)$ plummeted 17.16%, marking its second-largest single-day drop since 1990. Meanwhile, the $Hang Seng Index (800000.HK)$ and $Hang Seng China Enterprises Index (800100.HK)$ tum...