No Data

399006 Chinext Price Index

- 1934.46

- -12.73-0.65%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Shenzhen Mindray Bio-Medical Electronics' Q1 revenue decreased by 12.12% year-on-year, and Net income decreased by 16.81% year-on-year | Earnings Reports Insights.

More news is being continuously updated.

The brilliance of the heterojunction "shovel seller" is hard to maintain: Suzhou Maxwell Technologies has high inventory and accounts receivable, with impairment provisions exceeding 0.5 billion yuan | Interpretations

① Suzhou Maxwell Technologies has made an asset impairment provision of 0.524 billion yuan for 2024, mainly including bad debt provision for accounts receivable of 0.388 billion yuan and inventory write-down loss of 0.136 billion yuan; ② The company has high inventory and accounts receivable. In the first quarter of this year, the company continued to make an asset impairment provision of 0.18 billion yuan.

Sunwoda Electronic: In the first quarter, Net income soared by 21.23%, and Cash / Money Market significantly improved.

In the first quarter, Sunwoda Electronic's Net income soared by 21.23%, Cash / Money Market flow significantly improved, and Operation entered a fast lane. Key summary: Financial performance is impressive: Revenue reached 12...

Morgan Stanley's latest viewpoint! Will the Hong Kong stock market perform better than the A-share market?

If tariffs are reduced, the offshore market may outperform the onshore market, benefiting the Internet/Technology, Consumer (relief from deflation), and Medical (easing of China-US relations) sectors.

China International Capital Corporation: The resilience of China's Assets is highlighted, and the main lines of dividends, domestic substitutes, and consumer demand will be relatively dominant.

Since the beginning of the year, there have been two major variables affecting the market: one is DeepSeek rewriting the Technology narrative, and the other is the frequent changes in tariff policies after Trump's inauguration. The former has become a catalyst for the spring market in A-shares, while the latter has led to fluctuations in the market in April. Recently, stabilizing funds have entered the market, and tariff expectations have fluctuated, leading to market stabilization and recovery.

Contemporary Amperex Technology and other Battery manufacturers compete with new products as the supercharging and fast charging storm approaches | New forces at the auto show.

① Battery manufacturers took center stage at the auto show, with Contemporary Amperex Technology, Sunwoda Electronic, and Eve Energy Co., Ltd. competing with new products at the Shanghai Auto Show; ② A storm of ultra-fast charging has arrived, with megawatt fast-charging products from companies like BYD, Huawei, and ZEEKR showcased at the auto show.

Comments

$Shenzhen Component Index (399001.SZ)$ CLOSED UP 1.09%, AT 10470.91

$CSI 300 Index (000300.SH)$ CLOSED UP 0.25%, AT 3935.2

$Chinext Price Index (399006.SZ)$ CLOSED UP 0.69%, AT 2210.34.

THE HONG KONG STOCK MARKET CLOSED LOWER ON MONDAY, $Hang Seng Index (800000.HK)$ FELL BY 1.57% AND TECH WAS DOWN BY 2.37%.

CHIPMAKERS AND PHARMACEUTICAL FACTORIES ARE DOWN, $SMIC (00981.HK)$ DROPPED 2.15% AND CHINA TRADITI...

$Hang Seng Index (800000.HK)$ $Hang Seng China Enterprises Index (800100.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng China Affiliated Corporations Index (800151.HK)$ $SSE Composite Index (000001.SH)$ $Shenzhen Component Index (399001.SZ)$ $Chinext Price Index (399006.SZ)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $NASDAQ Golden Dragon China (.HXC.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $China Concept Stocks (LIST2517.US)$

���������...

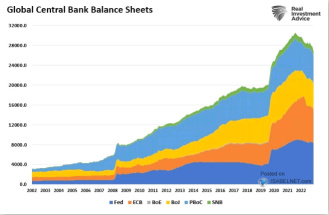

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

$SSE Composite Index (800146.HK)$ down 1.2%, $CSI 300 Index (800122.HK)$ down 1.18%.

$SSE Composite Index (000001.SH)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$ $BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $BYD Company Limited (002594.SZ)$ $BYD COMPANY (01211.HK)$

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.

Stock_Drift :