No Data

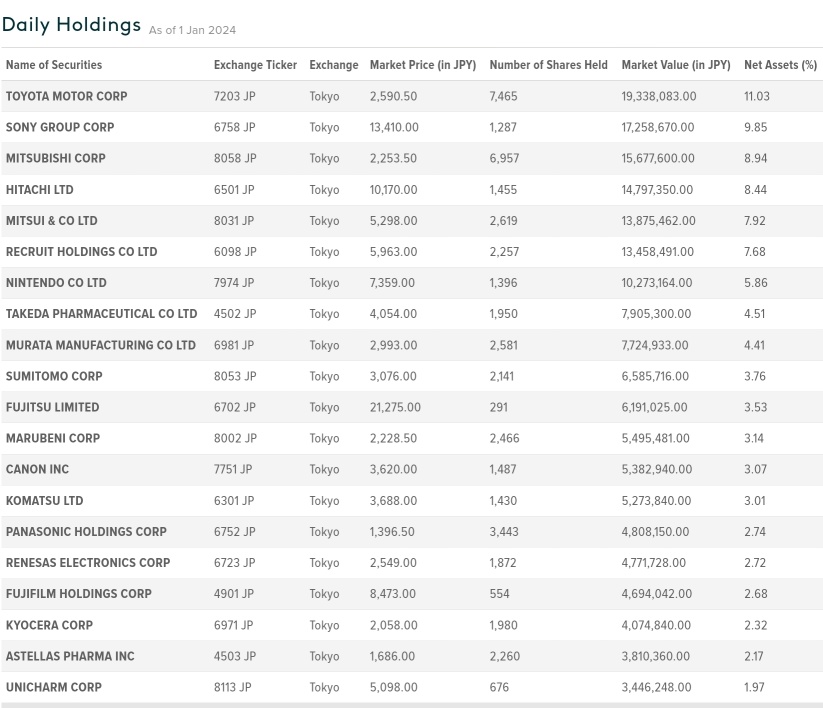

03150 Global X Japan Global Leaders ETF

- 68.420

- +0.920+1.36%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Is the Market Bullish or Bearish on Toyota Motor?

Market news: Sony is considering spinning off its Semiconductors Business, with the earliest being an independent listing this year.

According to informed sources, Sony is considering allocating most of its chip Business equity to Shareholders, retaining only a small portion of the equity; due to weak demand for Smart Phones, Sony's Semiconductors Business has also fallen into a growth stagnation; analysts state that the spin-off will give Sony's Semiconductors Solutions Group greater flexibility, while the group itself can also focus on its core Entertainment business.

Toyota Motor North America Reaffirms Its Commitment To A Hydrogen Society, Introduces Hydrogen-Related Plans, Investments, Debuts New Fuel Cell Technologies And Products Including North American Debut Of Its Gen 3 FC System

Today's Pre-Market Movers and Top Ratings | NVDA, TSLA, DPZ, and More

After the buying phase, individual stock selection will be guided by the financial results.

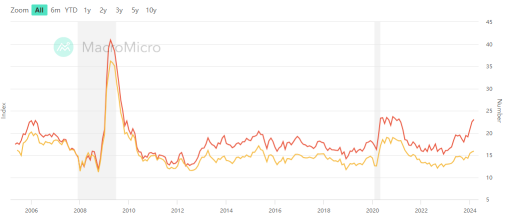

The Nikkei average has risen for four consecutive trading days. It ended trading at 35,839.99 yen, up 134.25 yen (with an estimated Volume of 2 billion 10 million shares). Following the purchase of tech stocks in the US market last weekend and favorable movements from major companies' earnings reports, the Nikkei average started with a buying lead, shortly rising to 36,075.26 yen after the trading began, recovering to the 36,000 yen level for the first time in about four weeks since April 1. Additionally, due to the yen depreciating to around 143 yen per dollar, export-related stocks were repurchased.

Nikkei Rises 0.4%, Led by Auto Stocks -- Market Talk

Comments

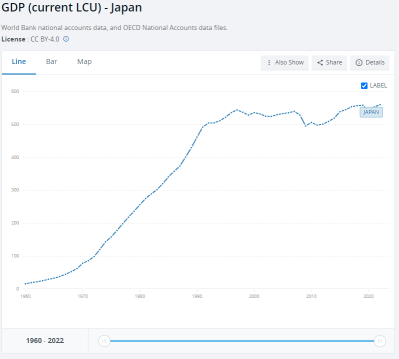

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...