No Data

02840 SPDR Gold Trust

- 2381.000

- +31.000+1.32%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Ringgit Strengthens Against Greenback In Early Trade

The sell-off is not over yet! USA Assets are still being "disdained" by overseas investors…

① According to data provided by Deutsche Bank, despite the market recovering over the past week, foreign investors' willingness to invest in USA assets continues to decline; ② Deutsche Bank's Forex research director George Saravelos believes that the recent data on USA capital flows is concerning.

Deutsche Bank warns: Overseas investors continue to withdraw from USA Assets, and the status of the dollar is facing challenges.

Deutsche Bank pointed out that, despite a market recovery in the past week, foreign investors remain cautiously observant regarding USA assets.

The Dallas Fed manufacturing survey has collapsed! The business activity Index has fallen to its lowest level since 2020.

The Federal Reserve Bank of Dallas in the USA released the results of the April Texas Manufacturing Outlook Survey.

Opening: US stocks opened slightly higher on Monday. This week the market focuses on Earnings Reports and economic data.

On the evening of April 28, Peking time, U.S. stocks opened slightly higher on Monday. Over 180 S&P component stocks, including Microsoft, Apple, Amazon, and Meta, will release their Earnings Reports this week. Important data such as non-farm employment and GDP will also be released this week. Investors continue to pay attention to the progress of trade negotiations. China has once again clarified that there are no negotiations or discussions on tariff issues between China and the U.S.

U.S. stock index futures slightly lower as the busiest week of Earnings Reports season approaches | Highlights for tonight.

①IBM plans to invest 150 billion USD in the USA over the next five years; ②MicroStrategy increased its shareholding by 15,355 Bitcoins last week; ③Rating agencies have downgraded the outlook for US ports to negative; ④Reports: Tencent, Alibaba, and ByteDance are scrambling to purchase computing power resources.

Comments

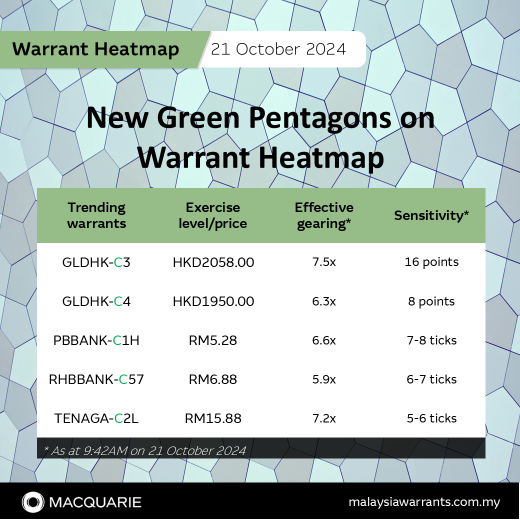

• Last week, GLDHK was up 3.5% to HKD1,942.00 while local underlyings such as PBBANK, RHBBANK and TENAGA were up by 6.0%, 2.7% and 1.5% respectively.

• Investors can refer to the heatmap pentagon alert on our homepage which shows all un...

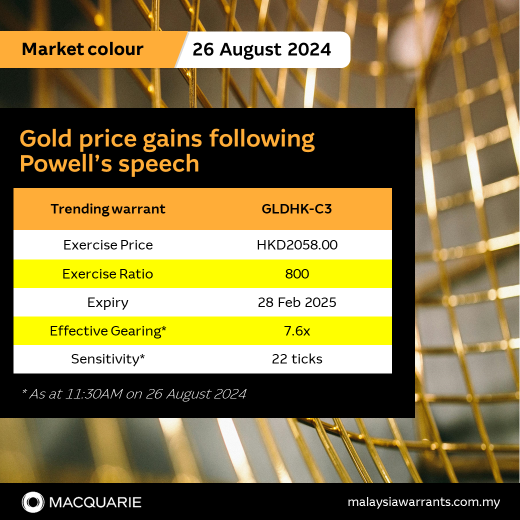

•The SPDR® Gold Trust (GLDHK; 2840 HK) is up 0.7% to HKD1,811 as at 10.45AM this morning, 3.7% higher month-to-date.

•The GLDHK is an exchange traded fund (ETF) with shares listed on the Hong Kong exchange. It is designed to reflect the price performance of the gold bullion as it tracks the LBMA ...

•Investors may gain leveraged exposure to the Japan market with Macquarie's focus NIKKEI call (NIKKEI-CI and NIKKEI-CH) and put warrants (NIKKEI-HE). Check out their live matrix here.

💹Shares of S P Setia (SPSETIA) traded highe...