No Data

02669 CHINA OVS PPT

- 5.250

- -0.010-0.19%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] CITIC SEC: Remains Bullish on the dividend value of the Property and Commercial Management Sector.

Jinwu Financial News | CITIC SEC's Research Reports state that various regions have introduced policies to boost Consumer spending, all of which incorporate stabilizing the Real Estate market into their policy framework. The importance of the Real Estate Industry in boosting Consumer policies is reflected not only in the consumption directly or indirectly related to housing but also in the significant impact of housing price wealth effects on residents' income confidence and willingness to consume. It is believed that national policies will be introduced in April to May, and developers with strong product capabilities and companies holding quality Operation Assets possess investment value; there is continued optimism regarding the dividend value of the property and commercial management Sector.

[Brokerage Focus] BOCOM INTL: CHINA OVS PPT's management scale expansion supports stable growth. Maintain a "Buy" rating.

Jinwu Financial News | BOCOM INTL analysis states that CHINA OVS PPT (02669), driven by CHINA OVERSEAS and projects from third-party developers, is expected to exceed a management scale of 0.5 billion square meters in 2026, supporting high single-digit revenue growth from 2025 to 2027. The gross margin is expected to remain stable at 16-17%, net margin will be maintained at 11%, and net income is projected to increase year-on-year by 9.3%, 6.0% and 6.0% respectively. The current valuation corresponds to a PE of 8.2 times for 2025, which is at the historical bottom range, maintaining a Target Price of 6.3 HKD and a "Buy" rating.

Hong Kong stock fluctuations | CHINA OVS PPT (02669) rose over 3%, the company's gross margin improved last year, and the Business structure of value-added services was optimized.

CHINA OVS PPT (02669) rose over 3%, as of the time of writing, it is up 2.56%, priced at 5.2 Hong Kong dollars, with a transaction amount of 53.7813 million Hong Kong dollars.

[Brokerage Focus] CITIC SEC expects that the Property Service industry will encounter three major opportunities in 2025.

Jinguo Financial News | CITIC SEC believes that the Property Service Industry will迎来three major opportunities in 2025. First, the price mechanism is gradually being rationalized, pushing for a policy turning point that promotes quality services at competitive prices. It is expected that the current difficulties in collections may ease, and companies providing good services for quality properties will be more encouraged by policies; secondly, a turning point in enterprise operation quality. The bank expects that by 2025, the performance contribution of cyclical businesses (serving developers) to the Sector will drop to nearly zero, with the accrual of goodwill and receivables impairment peaking, leading to an expected performance growth rate of 9.7% in the Sector, with sustainable profitability expected to improve significantly; finally, companies will continue to increase Cash.

CITIC SEC: Quality and price matching may become a direction encouraged by policy. The property Sector has significant upward elasticity in the future.

The bank suggests that investors pay attention to the policy turning point in the Property Service Sector.

CICC: Maintains CHINA OVS PPT (02669) “Outperform Industry” rating with a Target Price of 6.5 Hong Kong dollars.

Considering CHINA OVS PPT's market position and service quality, CICC believes that it is likely to maintain a certain volume of new expansion contracts, supporting the growth of revenue in the Business management sector.

Comments

The sales volume of China's top 100 real estate companies fell 13% MoM in April. Chinese developers took the lead to decline. $KWG GROUP (01813.HK)$ and $AGILE GROUP (03383.HK)$ plummeted...

UOB KH report.

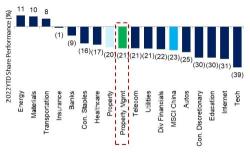

MSCI China now trades at an undemanding 12-month forward PE of 10.2x, or a 37.0% discount to Emerging Asia. This steep discount is unwarranted and they expect valuation to normalise in 2H23, backed by additional policy support. However, a significant rerating is only possible if credit growth accelerates; hence, their index target is at 74 points for now, implying 12.0x target PE. They prefer exposure to automobiles, co...

2023 outlook will be righter because of soothing property,Covid beta,(after 2-years roller-coaster ride).

Here are a few reasons:

1.most have changed in a good way for long term,For example ,rapid move into independence, non-resi, decline of excessive profitability);

even the headwinds (less new-home GFA, slower VAS) are useful to distinguish consolidators;

2.intact biz nature: asset-light wi...

103540795 : 18800soon.. 19000