No Data

02020 ANTA SPORTS

- 91.050

- -0.400-0.44%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Macquarie: Under the tariff scenario, the local brands in the sportswear industry are entering a phase of Global Strategy opportunities.

The bank stated that the issue of overcapacity in China's athletic shoe production is controllable, and is bullish on local brands in China, with ANTA SPORTS (02020) being the first choice.

Sustainable products account for over 30%, Anta aims for Carbon Neutrality by 2050.

Explore the sustainability of 'sustainability' itself.

CICC: Maintain ANTA SPORTS (02020) outperforming industry rating with a Target Price of HKD 120.92.

Anta Group has been upgraded three levels to an A rating on the MSCI ESG rating for two consecutive years and was selected for the Dow Jones Leading Emerging Markets Index for the first time, becoming the only footwear and apparel company among the six mainland Chinese enterprises.

ANTA Sports Products' (HKG:2020) Five-year Earnings Growth Trails the 8.7% YoY Shareholder Returns

A wave of buybacks in Hong Kong stocks, with 172 listed companies repurchasing 53.7 billion, and the buybacks have been continually increasing in recent years.

① A wave of stock buybacks has been sparked in the Hong Kong stock market, with 172 listed companies having implemented buybacks totaling 53.708 billion HKD; ② The main players in Hong Kong stock buybacks remain leading companies in the Internet and financial sectors, but some pharmaceutical and Consumer firms have also increased their buyback efforts.

Hong Kong stocks are experiencing fluctuations | Sporting Goods stocks are rising as the Sports Industry welcomes Bullish news recently, and the penetration rate of domestic sports shoes and clothing is expected to accelerate.

The sporting goods stocks collectively rose. As of this report, POU SHENG INT'L (03813) increased by 4.35%, trading at 0.48 HKD; XTEP INT'L (01368) rose by 4.25%, trading at 4.91 HKD; TOPSPORTS (06110) went up by 3.2%, trading at 2.9 HKD.

Comments

Revenue growing since 2018 with CAGR 22%! With multi-branding strategy like FILA, DESCENTE, AMER SPORT AND KOLON, it able to penetrate oversea market. Cash from operating growing since 2018 with CAGR 28% and dividend/share grew at CAGR 14%. Nothing to say just INCREDIBLE double digit growth!

ROE, ROIC and operating margin growing steadily, contributed by having vertical integration which reduce costs and i...

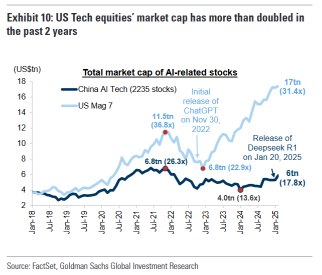

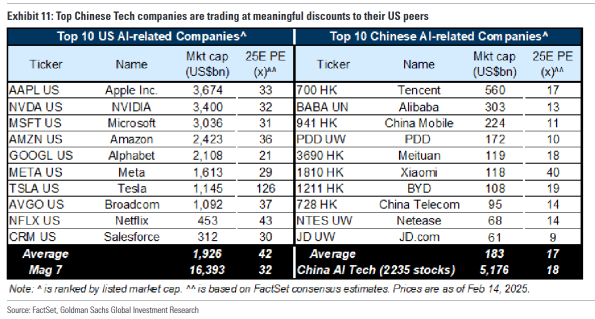

Wall Street banks have issued optimistic reports on Chinese tech stocks, signaling potential revaluation.

Goldman Sachs analyst Kinger Lau published a report titled “AI Changes the Ga...

McDonalds Corporation (MCD US) $McDonald's (MCD.US)$

Daily Chart -[BULLISH ↗ **]MCD US consolidating above 290.35 support. As long as price is holding above this level, we expect a bounce towards 317.20 resistance. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlestick closing below 290.35 support level could open drop towards next support...

$MEITUAN-W (03690.HK)$

$BIDU-SW (09888.HK)$

$BABA-W (09988.HK)$

$CHINA VANKE (02202.HK)$

$CITIC SEC (06030.HK)$

$CITIC BANK (00998.HK)$

$ZHONGLIANG HLDG (02772.HK)$

$BYD COMPANY (01211.HK)$

$HTSC (06886.HK)$

$SHK PPT (00016.HK)$

$ICBC (01398.HK)$

$HSBC HOLDINGS (00005.HK)$

$PING AN (02318.HK)$

$JD-SW (09618.HK)$

$ANTA SPORTS (02020.HK)$

Click here for Top Trending Posts

Securities & Brokerage: $HTSC (06886.HK)$ $CMSC (06099.HK)$

Gaming Software: $NTES-S (09999.HK)$ $XD INC (02400.HK)$ $NETDRAGON (00777.HK)$

Digital Solutions: $TENCENT (00700.HK)$ $TRAVELSKY TECH (00696.HK)$ $CHINASOFT INT'L (00354.HK)$

Online Retailer: $BABA-W (09988.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$

Insurer: $PING AN (02318.HK)$ $AIA (01299.HK)$ $CHINA LIFE (02628.HK)$

Telecommunication: $CHINA MOBILE (00941.HK)$ $CHINA TELECOM (00728.HK)$

���������...