No Data

01799 XINTE ENERGY

- 4.500

- +0.050+1.12%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] Guotai HAITONG SEC: The understanding of the Electrical Utilities market among companies and investors will change in 2025-2026.

Jinwu Financial News | Guotai HAITONG SEC states that in 2025-2026, both power companies and investors will change their understanding of the electrical utilities market. Currently, the further north you go, the better the coal power generation price: the higher the proportion of new energy, the scarcity of coal power generation is evident. At the same time, this year's annual long-term contract prices in the south have also put pressure on coal power generation there, as power plants shift from pursuing quantity to focusing on price and efficiency, and recently, spot electricity prices in the south have started to rise. It is believed that the possibility of northern electricity prices bottoming out is already quite high, while regional disparities in the south still exist. In the future, we may witness two historic firsts: 1. Rising spot electricity prices in 2025, 2. Increased annual long-term contracts in 2026.

XINTE ENERGY: Annual Report 2024

Highlights from the Brokerage morning meeting: Demand improved in the first quarter, and performance recovery in the Electrical Utilities New energy Fund industry is expected.

In today's Brokerage morning meeting, Sinolink believes that the core logic of incremental policies is becoming clearer; China Securities Co.,Ltd. noted that the current expectations for Fuel Cell Energy vehicles in the Sector are relatively weak, and there might be an upward inflection point in sales during the peak season in May-June; HTSC suggested that the demand is improving in the first quarter, and the performance recovery of Electrical Utilities New energy industry is expected.

Hong Kong stocks are moving differently | Solar stocks dropped today as the current solar installation rush comes to an end, and the quotes in the solar Industry Chain are accelerating their loosening.

Photovoltaic stocks fell today. As of the time of writing, FLAT GLASS (06865) is down 4.7%, trading at HKD 8.31; IRICO NEWENERGY (00438) is down 2.8%, trading at HKD 2.08; XINYI SOLAR (00968) is down 2.66%, trading at HKD 2.56; XINTE ENERGY (01799) is down 1.32%, trading at HKD 4.5.

China Great Wall: In March, the solar Industry in China showed signs of stabilization and recovery, with the Power Inverter expected to recover first.

After a year of adjustment in the Industry, 2024 may mark the bottom of profitability. The Power Inverter is expected to recover first due to technological barriers, and the supply-demand rebalancing will optimize the competitive landscape.

Pacific Securities: The Quote for The Pacific Industry Chain in the photovoltaic sector is accelerating downward.

With the end of inventory preparation, the Quote in the photovoltaic Industry Chain is accelerating to loosen, due to significant price drops in the downstream market and an increased shipping intention from some leading Polysilicon manufacturers, the price of Block Orders for Polysilicon is rapidly declining, approaching mainstream cash costs.

Comments

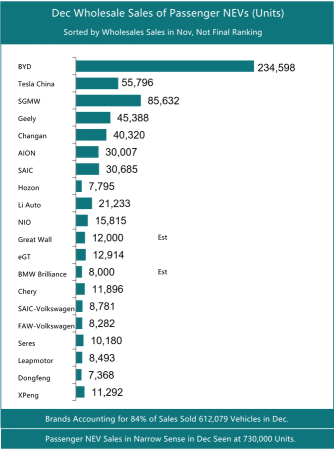

$Chongqing Changan Automobile (000625.SZ)$ $SAIC Motor Corporation (600104.SH)$ $Li Auto (LI.US)$ $LI AUTO-W (02015.HK)$ $NIO Inc. USD OV (NIO.SG)$ $NIO-SW (09866.HK)$ $GWMOTOR (02333.HK)$ $BAYER MOTOREN WERK (BMWYY.US)$ $VOLKSWAGEN A G (VWAGY.US)$ $LEAPMOTOR (09863.HK)$ $DONGFENG GROUP (00489.HK)$ $Dongfeng Automobile (600006.SH)$ $XPeng (XPEV.US)$ $XPENG-W (09868.HK)$ $XINTE ENERGY (01799.HK)$ $BYD COMPANY (01211.HK)$ $BYD Company Limited (002594.SZ)$