No Data

01760 INTRON TECH

- 1.310

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

INTRON TECH: 2024 Annual Report

[Brokerage Focus] CMB International maintains Buy rating for INTRON TECH (01760), stating that its performance last year met expectations.

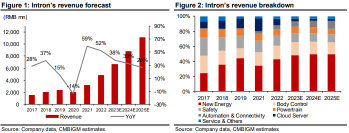

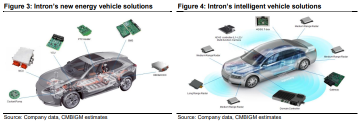

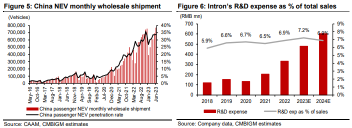

Jinwu Financial News | According to a Research Report from Zhuhai International, after INTRON TECH (01760) released its earnings, the firm has communicated with management. Although the company achieved a stable year-on-year revenue growth of 15% driven by New energy Fund / Asia Vets connected / body systems (growth of 24% / 27% / 11% respectively); due to the OEM price war, GPM is expected to decline to 14.5% in 2024 (down from 18.7% in 2023). Looking towards 2025, management holds a positive outlook on revenue prospects and GPM, especially as the New energy and Asia Vets business segments will benefit from the trends in new energy vehicles, smart driving, and clients' overseas expansion.

INTRON TECH (01760.HK) had a total annual revenue of 6.693 billion yuan, an increase of 15% year-on-year.

On March 28, Glonghui reported that INTRON TECH (01760.HK) announced that for the year ending December 31, 2024, the company's total revenue was RMB 6,693.1 million, an increase of 15% compared to last year, mainly due to the growth recorded by most of the group's Autos business segments, particularly the New energy Fund and smart connected Autos, which performed especially well, continuing to show robust growth. The group's net income for the current year decreased by 35% from RMB 312.5 million last year to RMB 204.2 million for the year ending December 31, 2024. The Board of Directors decided.

INTRON TECH (01760) announced its annual results, with a Shareholder's attributable profit of 0.209 billion yuan, a decrease of 34% year-on-year, and plans to declare a final dividend of 6.3 Hong Kong cents per share.

INTRON TECH (01760) announced its annual performance for the year ending December 31, 2024, with total revenue of RMB...

Express News | Intron Technology - Final Dividend of HK6.3 Cents per Share

Express News | Intron Technology Holdings FY Gross Margin 14.5%

Comments

Some Intron Technology Holdings Limited (HKG:1760) Analysts Just Made A Major Cut To Next Year's Estimates

Some Intron Technology Holdings Limited (HKG:1760) Analysts Just Made A Major Cut To Next Year's EstimatesIntron Tech will announce its 1H23 results next week. We estimate 1H23E revenue of RMB 2.66bn (+28% YoY) and net income of RMB 191mn (+25% YoY). The solid growth was mainly due to strong NEV shipment and rising penetration of auto electrification/intelligence, partly offset by OEM price pressure, weaker cloud server and higher R&D expenses. Looking ahead, we expect a back-loaded 2H...

Key Takeaways:

1. Intron has been able to secure good semico...