DeepSeek's Emergence: Is the World Beginning to Reassess China's Value?

DeepSeek's Emergence: Is the World Beginning to Reassess China's Value?

$Agora (API.US)$ Following the introduction of China's groundbreaking DeepSeek technology, Wall Street giants Goldman Sachs and Deutsche Bank have revised their investment outlooks for the Chinese market. Goldman Sachs released a report on Tuesday forecasting a 14% potential increase in the MSCI China Index for the year. Shortly thereafter, Deutsche Bank also expressed optimism, advising investors to actively engage with the Chinese market. They noted that Chinese assets are at the nascent stages of a bull market with expectations to reach new heights in the medium term.

$聲網 (API.US)$ 在中國突破性的DeepSeek技術推出後,華爾街巨頭高盛和德意志銀行已經調整了對中國市場的投資前景。高盛於週二發佈了一份報告,預測MSCI中國指數在今年有可能上漲14%。隨後,德意志銀行也表示樂觀,建議投資者積極參與中國市場。他們指出,中國資產正處於牛市的初期階段,預計在中期內將達到新高。

The debut of DeepSeek signifies a major leap in global technological competition for China.

DeepSeek的首次亮相標誌着中國在全球科技競爭中的重大飛躍。

This artificial intelligence system not only underscores China's competitive edge in high-tech sectors but also highlights the growing dominance of Chinese companies on the global stage. Deutsche Bank analysts have likened the success of DeepSeek to China's "Sputnik moment," a pivotal time when a nation's technological and innovative prowess is internationally acknowledged.

這個人工智能系統不僅強調了中國在高科技行業的競爭優勢,還凸顯了中國公司在全球舞臺上日益增長的主導地位。德意志銀行的分析師將DeepSeek的成功比作中國的"斯普特尼克時刻",這是一個國家的技術和創新能力在國際上得到認可的關鍵時刻。

Deutsche Bank states that global investors often significantly underweight China in their portfolios, emphasizing that the current performance of Chinese companies, particularly in contrast to Western firms, should not be ignored. The manufacturing sector in China has shown remarkable strength, especially in industries like basic electronics, steel, and shipbuilding. By 2025, China is also expected to launch the world's first sixth-generation fighter jet, reinforcing its leadership in high-end manufacturing and complex industrial fields.

德意志銀行指出,全球投資者在其投資組合中通常顯著低配中國資產,並強調當前中國公司的表現,特別是與西方公司的對比,不應被忽視。中國的製造業表現出顯著的實力,尤其是在基礎電子、鋼鐵和造船等行業。到2025年,中國還預計將推出全球首款第六代戰鬥機,鞏固其在高端製造和複雜工業領域的領導地位。

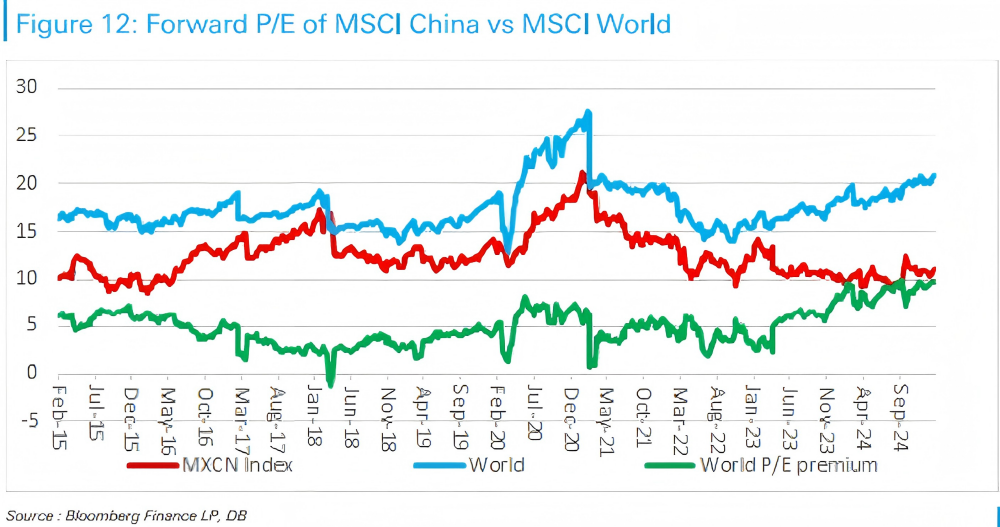

Furthermore, Deutsche Bank anticipates that the existing "valuation discount" on China's stock market will gradually vanish. Enhanced by supportive policies and financial liberalization, this adjustment is poised to catalyze continued growth. The bull market that began in 2024 within the A-share and Hong Kong stock markets is projected to sustain its momentum and exceed previous peaks in the coming years.

此外,德意志銀行預測,當前中國股市的"估值折扣"將逐漸消失。藉助支持政策和金融自由化,這一調整有望催化持續增長。自2024年開始的A股和香港股市的牛市預計將在未來幾年保持其勢頭,並超過之前的高點。

Goldman Sachs projects a 14% rise in the MSCI China Index this year

高盛預測,MSCI中國指數今年將上漲14%

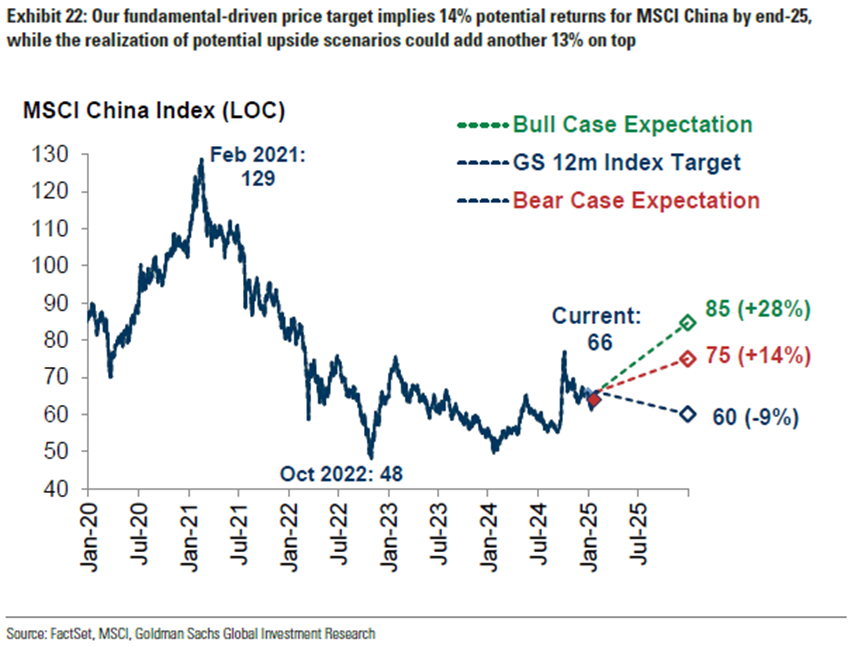

According to a recent report, the MSCI China Index is currently positioned at approximately 66 points. Goldman Sachs predicts a potential increase to 75 points under a neutral scenario. In a more optimistic forecast, the index could surge by as much as 28%.

根據最近的一份報告,MSCI中國指數目前約爲66點。高盛預測在中立情景下,指數有可能上漲至75點。在更樂觀的預測中,該指數可能上漲高達28%。

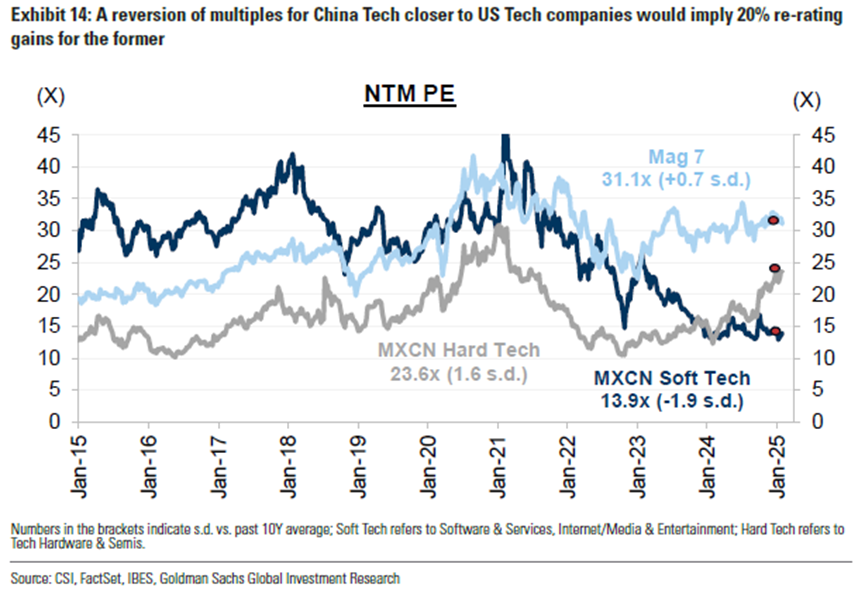

The bank highlights the launch of DeepSeek as a pivotal development in the artificial intelligence sector, marking a shift from hardware infrastructure to software applications. This transformation challenges the traditional notion of "American exceptionalism" and opens up new avenues for diversified growth in the global market, particularly benefiting Chinese tech stocks. Goldman Sachs is especially optimistic about the prospects for Chinese tech stocks, citing potential productivity boosts and technological advancements that could help narrow the significant valuation gap—up to 66%—between U.S. and Chinese tech or semiconductor stocks.

該銀行強調DeepSeek的推出是人工智能板塊的一個關鍵發展,標誌着從硬件基礎設施向軟體應用的轉變。這一轉變挑戰了傳統的「美國例外主義」觀念,併爲全球市場創造了多元化增長的新途徑,特別有利於中國科技股票。高盛尤其對中國科技股票的前景持樂觀態度,提到潛在的生產力提升和技術進步可能縮小美國與中國科技或半導體股票之間高達66%的顯著估值差距。

It's time to pay attention to Chinese tech stocks

是時候關注中國科技股票了

During the Spring Festival, Chinese assets showed strong performance, with the FTSE China A50 futures increasing by 1.85% and the Nasdaq Golden Dragon China Index rising by 1.15% from January 28 to January 31. AI-related Chinese companies such as Agora $Agora (API.US)$ , Kingsoft Cloud $Kingsoft Cloud (KC.US)$ , and Alibaba $Alibaba (BABA.US)$ experienced notable gains of 16%, 11%, and 10%, respectively, drawing significant investor interest.

在春節期間,中國資產表現強勁,從1月28日至31日,富時中國A50期貨上漲了1.85%,納斯達克黃金龍中國指數上漲了1.15%。與人工智能相關的中國公司,如聲網 $聲網 (API.US)$ ,金山雲 $金山雲 (KC.US)$ ,和阿里巴巴 $阿里巴巴 (BABA.US)$ 分別實現了16%、11%和10%的顯著增長,吸引了投資者的極大關注。

The buzz around DeepSeek, particularly its ability to deliver performance comparable to GPT but at a lower cost, has led investors to reevaluate the technological capabilities of Chinese tech firms in the AI space. Reports from JPMorgan and Citibank suggest that DeepSeek has catalyzed six major AI investment opportunities, with companies like Alibaba, Tencent, Kingdee, and Xiaomi poised to benefit.

有關DeepSeek的熱議,特別是它能以更低的成本提供與GPT相當的性能,促使投資者重新評估中國科技公司在人工智能領域的技術能力。摩根大通和花旗銀行的報告表明,DeepSeek催生了六個主要的人工智能投資機會,包括阿里巴巴、騰訊控股、金蝶和小米等公司將從中受益。

Overall, among global technology-related investment opportunities, Chinese tech stocks are likely to gain increasing recognition. The potential and influence of the Chinese market are significant and should not be underestimated by global investors, who are advised to keep a close watch on these developments. Moreover, with the U.S.-China trade war quietly escalating, investors are also cautioned to consider its potential negative impacts.

總體而言,在全球科技相關投資機會中,中國科技股票可能會獲得越來越多的認可。中國市場的潛力和影響力非常顯著,全球投資者不應低估,要密切關注這些發展。此外,隨着美中貿易戰悄然升級,投資者也應警惕其可能產生的負面影響。